Moneysworth wins Best Small Protection Advice Firm 2023!

Learn more

Call us 01625 462 744

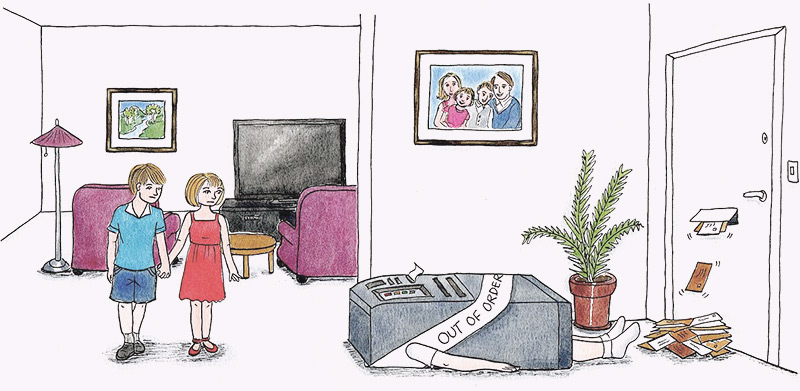

When you think of protection insurance, your first thought might be life insurance. Life cover is certainly important to make sure your family don’t lose out financially, should the worst happen.

Ideally, you should have life cover for the following eventualities:

While life insurance is undoubtedly important, don’t underestimate the importance of critical illness and income protection insurance.

Critical illness insurance provides a lump sum should you contract a serious illness, such as heart disease, stroke, multiple sclerosis and more advanced cancers. This lump sum can then be used to pay off your mortgage and/or to pay medical and care costs and/or to convert your home to make domestic arrangements easier while you are ill.

Another valuable feature of critical illness is that you can also cover your children, so that you receive a sum of money if one of them was diagnosed with a serious illness.

Income protection insurance pays a replacement income should you be unable to work for an extended period due to accident or sickness. Income protection can either be long-term, i.e. it will pay out until the policy ends or you go back to work; or short-term, where the length of time it pays out for is limited to perhaps one, two or five years.

These types of insurance can be of benefit to almost anybody. Anyone can contract a critical illness, and anyone can become ill and need to take time off work, indeed you probably know someone who has been forced to do this at some stage.

If you are single with no dependants, then you might also have little need for life cover, especially if you also don’t have a mortgage. Critical illness and income protection might therefore be a higher priority.

Unfortunately, serious illnesses are far from uncommon. For example, Cancer Research UK says that 1,000 people are diagnosed with cancer in the UK every day. The British Heart Foundation claims that 260 people will need to be admitted to hospital today, as a result of a heart attack. Leading insurer LV asserts that a 30-year old man has a 21% chance of contracting a serious illness before age 70.

Life insurance policies only pay out when you die, or if a medical professional believes you have a terminal illness that will lead to death within 12 months. Cancer Research UK also says that 50% of people diagnosed with cancer live for at least 10 years. This means that people are increasingly likely to survive critical illnesses and to require medical and other assistance for several years while living with the condition.

This is a different type of insurance that normally only covers the direct costs of your treatment. You need critical illness insurance if you want to pay for longer-term care, or to modify your home, or to pay off your mortgage.

This may be true, but remember that they might need to stop work, or at least reduce their working hours, to do this, thus reducing the household income significantly. You might also need specialist nursing care that only a healthcare professional can provide, or you might want to pay for modifications to your home to help with your domestic living arrangements while you are ill. It’s also great to have the peace of mind that your mortgage will be paid off if you become critically ill.

The insurers Moneysworth typically uses all had payout rates of between 87% and 98% for critical illness insurance claims, according to their most recent annual statistics.

Large numbers of people need to take time off work due to illness, indeed you may well know someone who has had to do this recently. Government data shows that, at the time of writing, 2.5 million people of working age in the UK are on long-term sick leave.

Many employers do give you sick pay for a certain time, but how many will carry on paying you for several years? You might need to check your employee handbook very carefully. Even if you know of a colleague who was paid in full for a six-month absence, it is possible that the company did so on a discretionary basis, and that it was not contractually obliged to do so.

One of the best things about income protection policies is that they come with a range of ‘deferred periods’. The deferred period is the length of time for which you need to be off work before the policy starts to pay out. If your employer doesn’t give you any sick pay, you can select a deferred period of four weeks (usually the shortest deferred period available with this type of insurance). If your employer will give you full pay for three months, you can choose a 13-week deferred period.

At the time of writing, state support for those on sick leave is just £109.40 per week, which is clearly a very limited amount. The application process for this benefit can also be very complex.

Income protection premiums can be fairly significant, but this is because the insurer might need to keep paying a significant proportion of your salary for the rest of your working life, in the worst case scenario. Consider that, in return for your premium, you get considerable peace of mind. If affordability is an issue, we can look to arrange a cheaper short-term policy for you, where the payout period might be capped at one, two or five years.

Many insurers will still offer this cover to the self-employed. Also, if you’re thinking that you could still generate an income from the business if you were ill, consider carefully how realistic this is. If it’s a small business and you are a senior manager, it could well be the case that the business is severely affected by your absence.

The insurers Moneysworth typically uses all had payout rates of between 81% and 93% for income protection insurance claims, according to their most recent annual statistics.

Moneysworth are experts in arranging critical illness and income protection insurance. We are a whole-of-market specialist protection broker and we can search the entire marketplace to find the most suitable product and provider for your individual circumstances. Contact us today to find out more.

You may be aware of the Consumer Duty, which was introduced by our regulator, the Financial Conduct Authority (FCA), on 31st July 2023.

The Consumer Duty places new obligations in financial services firms to take positive actions to ensure they deliver good outcomes for their clients.

Moneysworth believes that, in order to ensure our clients get the very best outcomes, we need to explore all possible options when it comes to finding a suitable provider and product.

If this applies to you, then give Moneysworth a try. We cannot guarantee that we can get you covered, but we promise to do our very best.

Other brokers who say they can’t help you might not be protection specialists, or it might be that they are unwilling to take on the extra work involved with a more complex case. Neither of these apply to Moneysworth. Life insurance and other areas of protection are the only areas we advise on.

We have extensive experience of securing insurance for clients with many different medical conditions. We know which providers are likely to consider your application sympathetically. We are not afraid to challenge insurers if we think they have been unreasonable in declining an application, or if they are proposing to charge an unduly large premium, and we have been successful in this respect on a number of occasions.

Contact us today if you’ve been finding it difficult to get life insurance, critical illness insurance or income protection insurance.

The central idea of the Financial Conduct Authority’s new Consumer Duty initiative is that clients should receive “good outcomes”.

When it comes to life and health insurance protection, this is likely to mean that firms will need to take a ‘holistic’ approach, meaning that they will need to consider all of a client’s potential protection needs, rather than perhaps thinking just about life protection in one or two areas.

Similar sentiments have been expressed in several recent trade press articles.

This means considering not only life insurance for the mortgage balance, but also critical illness insurance, as well as some form of income protection or payment protection insurance, as there is a much greater risk of becoming ill during your mortgage term as there is of passing away.

It also means considering all potential protection needs, rather than perhaps just concentrating on life cover.

If an authorised firm decides it doesn’t want to get involved in protection advice, then it has the opportunity to establish an arrangement with a partner firm, whereby insurance leads are passed on to this other firm.

In the new Consumer Duty world, Moneysworth is able to give advice in all areas of protection, including:

One of our particular specialisms is arranging suitable cover for individuals who may otherwise have found it difficult to obtain protection elsewhere.

We have helped large numbers of clients whose circumstances may be a little unusual. For example, they might:

If you wish to find out more about arranging suitable insurance for yourself, then contact Moneysworth today to find out how we can help you.

Moneysworth is well placed to become your protection specialist partner firm in the brave new world of the Consumer Duty.

Since our foundation in 2003, we have become an established and respected name in the protection sector, with numerous satisfied clients and several industry awards to our name.

We invite you to place your trust in Moneysworth’s highly experienced team, who have many years’ experience of the protection market and of helping clients just like yours to achieve fantastic outcomes.

If you want to discuss the opportunities offered by introducing business to Moneysworth, get in touch with us today.

Moneysworth specialises in finding life insurance and other forms of protection for people who might be considered higher risk or who may have been declined when they made applications via other brokers.

This includes arranging cover for people who have tested positive for HIV.

It’s also not that unusual for us to be able to help clients with a history of HIV, as we succeeded here on nine separate occasions in the three-month period from March to May 2023. It should be noted that as many as four different insurers offered terms to our clients in these cases. If you try hard enough, it’s often possible to obtain cover, and you don’t always need to confine your search to one or two specialist providers either.

It’s not just life insurance we can help with either, as we have also been successful in obtaining income protection insurance – policies that pay a replacement income if you can’t work due to accident or sickness – for people with HIV.

Medical advances in this area have been remarkable, and now many people living with HIV can enjoy long, healthy lives. Insurance companies are therefore much more willing to offer cover to people with HIV than was previously the case.

When you apply, the insurer is likely to want to know when you were diagnosed with HIV, and some additional medical details, such as your viral load, CD4 count and any medication you have been prescribed.

46-year-old man

34-year-old man

46-year-old woman

28-year-old woman

Moneysworth boasts a highly skilled and experienced team who know the best approaches to take when dealing with clients who have a history of HIV and other medical conditions.

We are whole-of-market brokers and can consider all insurers in the marketplace. This means that there is a better chance of obtaining competitive life cover than is the case were you to approach a broker who uses a limited panel of providers.

Contact us today and see how we can help you.

For people looking at arranging cover now, and for those who have existing cover, a key concern is will the insurer pay out if a claim is made relating to Coronavirus?

The UK protection insurance industry (Life Insurance, Critical Illness and Income Protection) has a very positive record on life insurance claims. According to the Association of British Insurers (ABI), in 2019, 98% of all protection insurance claims were paid out.

We will have to wait until 2021 to get the overall UK insurance payout statistics for this year, but the insurer LV= has recently announced that they have so far paid out around £2.5 million in claims relating to Covid-19.

The key point to remember is that for Life Insurance, Critical Illness and Income Protection policies, Coronavirus has not changed the way in which claims are assessed.

Short answer: Most likely, yes.

People who develop very serious Coronavirus symptoms will likely have to go into intensive care and be put onto ventilators. Some will recover but, sadly, some will die. For Life Cover policyholders who die as a result of the Coronavirus, a life insurance claim should not be affected, meaning that their loved ones will receive a payout from the insurer.

Short answer: Probably, but it would need to be after the end of the deferment period – and, due to the nationwide lockdown rules, deferment periods are now generally longer for new policyholders.

Income Protection is designed to pay the policyholder part of their income if they’re unable to work due to illness or accident. If someone is not able to work due to ‘shielding’ or ‘self-isolation’ then that would not be covered by Income Protection insurance.

For people with existing Income Protection policies which have been taken out prior to the Covid-19 outbreak, the terms and conditions remain unchanged. Insurers will pay Coronavirus-related claims on existing policies once the policyholder has reached the end of the deferred period if they still unable to return to work due to their illness.

For new Income Protection applications, some insurers have increased the minimum period before a claim can be made after the policy starts (this is known as a deferred period). The aim of this increase is to ensure that any period of self-isolation would have come to an end before a claim can be made. If the policyholder is ill with Coronavirus at the end of a deferred period and beyond, they would be eligible to submit a claim.

Short answer: In most cases no, but in a few cases possibly yes.

Most critical illness claims are unaffected by the current crisis because most policies pay out on the diagnosis of one of the qualifying named critical illnesses on the policy. The majority of existing policies will have been taken out before the virus was known about, and new policies do not include cover for Coronavirus.

The most likely situation where a Critical Illness claim relating to Coronavirus may be paid would be if the policyholder needed to be put onto a ventilator. Insurance companies’ policies differ in the terms about the amount of time and degree of loss of respiratory function to be eligible to make a claim.

Short answer: Generally, not at the moment.

So far, we’ve not seen a general increase in the cost of standard premiums, but this might change in the future if insurers feel it’s necessary to do so.

However, if you already have a policy in place, your monthly premiums are likely to be fixed or guaranteed (unless you have reviewable premiums, low start options or index linked cover).

Now might be a good time to explore your Life Insurance options to protect your family and home in the event of death and/or critical illness and to insure your income.

Having type 1 or type 2 diabetes often makes it harder or even impossible to find suitable Life Cover, Critical Illness Cover and Income Protection.

Life insurance companies typically have a range of different premium rates for people with diabetes. Different companies will place the same person in different price bands. The process of applying for cover can often take weeks – or even months – if medical reports need to be obtained and checked. And although the situation has somewhat improved for Life Cover in recent years, most insurers are still unwilling to consider Critical Illness or Income Protection for people with any type of diabetes.

Well, there’s definitely some good news here.

In recent years, we’ve seen improvements in the prices for Life Cover typically offered to people with diabetes.

Another encouraging development we’ve seen with a couple of insurers: after starting the life insurance policy, the insurers reward policyholders by reducing premiums if the customer can demonstrate improved control (i.e. if their HbA1c reading comes down by a certain amount). We think this is a very encouraging sign, not just because it can make cover cheaper, but because it demonstrates that the insurance market is starting to consider how to adapt to the unique circumstances of people with long-term health conditions.

If certain criteria are met, it’s now possible for people living with diabetes to get a “fast-track” application, which means cover could be in place immediately. Less stress, more peace of mind – exactly the kind of innovation we want to see for people with long-term health conditions who want to protect their financial security and their family’s future.

A year ago, there were hardly any options for people with diabetes to obtain Income Protection Insurance. For most it simply wasn’t available.

Moneysworth campaigned to improve that situation, and we’re pleased to see at least some people in the insurance industry listened to us!

With expert guidance, it’s now possible for some people who have type 2 diabetes to get Income Protection with no exclusions, subject to certain criteria. But for people with type 1 diabetes, although there is some availability, it’s extremely limited.

The situation for Critical Illness Cover has been slow to improve. It is now possible for people living with diabetes to obtain Critical Illness Cover – but the options are very limited and the chances of being offered cover are even narrower if they have type 1.

The small signs of progress we’ve seen in the market are a welcome start, but the fact is most insurance companies still don’t offer either of these protection products to people who have diabetes.

The charity Diabetes UK reports that there are around 3.7 million people who have been diagnosed with diabetes in the UK, and that figure is predicted to rise to 5 million by 2025*.

In light of this, we firmly believe that the insurance market needs a surge of innovation to make its products and services more forward-thinking and inclusive.

Moneysworth wants to see cover options and availability broaden for people living with diabetes, and so we’ll continue to lobby the insurance industry.

* Source: Diabetes UK ‘Facts & Figures‘