Moneysworth wins Best Small Protection Advice Firm 2023!

Learn more

Call us 01625 462 744

Here at Moneysworth, we might claim that “our specialist service has helped people with health conditions to find life insurance and other protection insurance.” When we look at the superb feedback clients with health conditions have given us, it’s easy to see just how we have managed to provide real solutions to real problems faced by individual clients.

Many of these people tell us about the difficulties they experienced obtaining cover, prior to contacting Moneysworth. Others mention that they had tried to get other brokers to help them, without success.

“After searching for life insurance with a heart condition, I came to the conclusion that no company would cover me, or the ones that would wanted to charge me a fortune. I decided to give it one last chance through Moneysworth to see if they could locate a policy that wouldn’t cost as much as a mortgage payment. After sending my initial inquiry, I was contacted by the most helpful protection consultant, Joanne Hallsworth. Joanne spent time with me to truly understand my needs and conditions. She then collaborated with Paul Rushton and came back with not only a cover that matched my needs perfectly but also a realistic price. While we all hope to never use life insurance, having a medical condition adds extra worry in case something happens and you want to ensure your family is supported.”

“Fantastic service. First contacted Moneysworth in 2022 to arrange life insurance with an underlying heart condition, after I’d been declined by a major provider. They were really informative, and talked through all the options available to best suit my family. They were then incredibly patient and professional when an unexpected health issue changed my circumstance. When I got back in touch in late 2023, they worked through several providers and managed to secure cover for me. A huge weight off my and my partner’s mind. Thanks so much to Jo and the wider team for persevering and all the help and advice.”

“The service was excellent. My case was a bit more complex than the standard life insurance case as I have a disability but I wanted to make sure I got insurance to protect my family. Malcolm supported me in this over a long period of time and was very helpful given I’d previously had a very bad experience with insurance. Malcolm didn’t give up and supported both myself and my partner in getting the right insurance we needed. He was absolutely amazing and I don’t think I’d have gone through with the process without him.”

“Perfect. They were incredibly patient and really listened to me with what I was after. They did not discriminate me at all for my mental or physical health and made sure I got the best deal possible.”

“Simple, efficient service by friendly people. Got me life cover when I had very difficult medical conditions.”

“Seamless great provider for Life Insurance, approachable understandable and knowledgeable staff who found the right insurer and product for me where other insurance companies refused cover. Took a few days from enquiry to finding and agreeing a provider and cover starting.”

We have had some major successes obtaining cover for clients with what appeared to be fairly serious health conditions. So if you’ve been struggling to get life insurance, critical illness insurance and income protection insurance, then contact Moneysworth today.

Life insurance is something you should very much be considering from the start of your adult life, especially if you have children, or a mortgage, or you earn more than your partner.

Income protection – which pays a replacement income should you be unable to work due to accident or sickness – is something you need to consider taking out as soon as you are in employment. What would the consequences be were you to cease receiving a wage and be forced to reply on the very limited state support?

Critical illness insurance might also be appropriate for adults of any age – after all you can be diagnosed with a serious illness at any age, no matter how young and healthy you might feel. This type of insurance is often taken out to protect a mortgage, and ensure the balance is paid off were you to be diagnosed with a critical illness. It is important to note, however, that critical illness can be a useful way of ensuring that you (and any children) can receive a lump sum to pay for medical treatment or nursing costs, or for the necessary modifications to your home to adapt to your condition.

Perhaps the best reason for taking out life insurance, critical illness insurance or income protection insurance at an early stage in your adult life is that your premiums will be much cheaper than would be the case at an older age.

If you would like to find out more, then contact Moneysworth today to see how we can help.

You may be aware of the Consumer Duty, which was introduced by our regulator, the Financial Conduct Authority (FCA), on 31st July 2023.

The Consumer Duty places new obligations on financial services firms to take positive actions to ensure they deliver good outcomes for their clients.

One of the main things the FCA wants to see from firms is known as the ‘price and value outcome’. This relates to whether retail customers are receiving ‘fair value’ for a product or service.

The ‘price’ part of this is easy to address, as when you approach Moneysworth for advice on your life insurance, critical illness insurance or income protection insurance needs, you won’t need to pay a fee at any point.

When it comes to delivering ‘value’ to our clients, we promise to:

Our commitment to providing value for our clients also means that we will do our very best to find insurance for you, regardless of your circumstances. We can never guarantee that we will be successful in finding an insurer to accept you, but there are many occasions in the past when we have been successful in securing cover for clients with all manner of different medical conditions.

If you have a medical condition, then it might be the case that the choice of insurers is limited, and you may also need to pay an increased premium. We promise, however, to find the most competitive premium available in the marketplace.

We also have extensive experience of finding cover for people who reside outside of the UK. Once again, these cases can be more complex, but we undertake to provide the very best service and find the best policy available.

If you have been told by another broker that you won’t be able to get life insurance, critical illness insurance or income protection insurance due to your health condition, or due to any other reason, then contact Moneysworth today to see how we can help.

You don’t have to have complex circumstances, such as a health condition or being an overseas resident, to be a Moneysworth client either. To get the very best advice on your life insurance, critical illness insurance or income protection insurance needs, contact us today and one of our experienced and knowledgeable advisers will be in touch.

No one needs any reminder that cancer is a serious illness, nor that it’s extremely common.

Around one in two of us will get cancer at some point in our lives and it’s one of the most common causes of death across the world.

Given this, you might assume that obtaining life insurance once you have experienced cancer would be impossible. Even if someone was judged to be free from cancer, would the insurers not be worried that the cancer might return?

It should be noted, however, that, in the UK, you are now more likely to survive cancer than die from it. This means that there are opportunities to obtain life cover should you have experienced cancer.

Moneysworth specialises in finding life insurance for people who might be considered higher risk or who may have been declined life cover when they made applications via brokers or when applying directly to an insurer. This includes arranging cover for people who have previously had cancer.

Sometimes, a life insurance policy is arranged with an exclusion for a particular illness, so the insurer might decide to offer you insurance where you are covered for death for illnesses other than cancer. We have often been successful, however, in arranging comprehensive life cover where the policy includes cover for death from the type of cancer that our client experienced previously.

Even if your policy excludes death from cancer, you would still have the peace of mind that death from other causes will be covered.

Even more worthy of note is that a number of our clients who have experienced cancer manage to obtain cover at standard rates, i.e. at the same monthly cost as any other applicant.

It is possible though that your premium might be subject to a rating, i.e. you would need to pay more each month than a client who had not experienced cancer.

It’s also not that unusual for us to be able to help clients with a history of cancer. We have successfully arranged life insurance in many such cases since our foundation in 2003.

(more…)

In our previous article, we gave an example of how charity signposting works. A young father with a lifelong heart condition tried for over two years to find an insurer willing to offer him Life Cover. Then a UK heart charity providing him with a list of brokers who specialise in assisting people with health conditions to find suitable insurance.

Likewise, a growing number of financial advisors now signpost to us when they have clients whose health condition is deemed to be higher risk, and the firm struggles to find an insurer willing to offer Life Cover to those clients.

Heart conditions and circulatory conditions are among the most common health conditions we see in the clients referred to us by financial advisors.

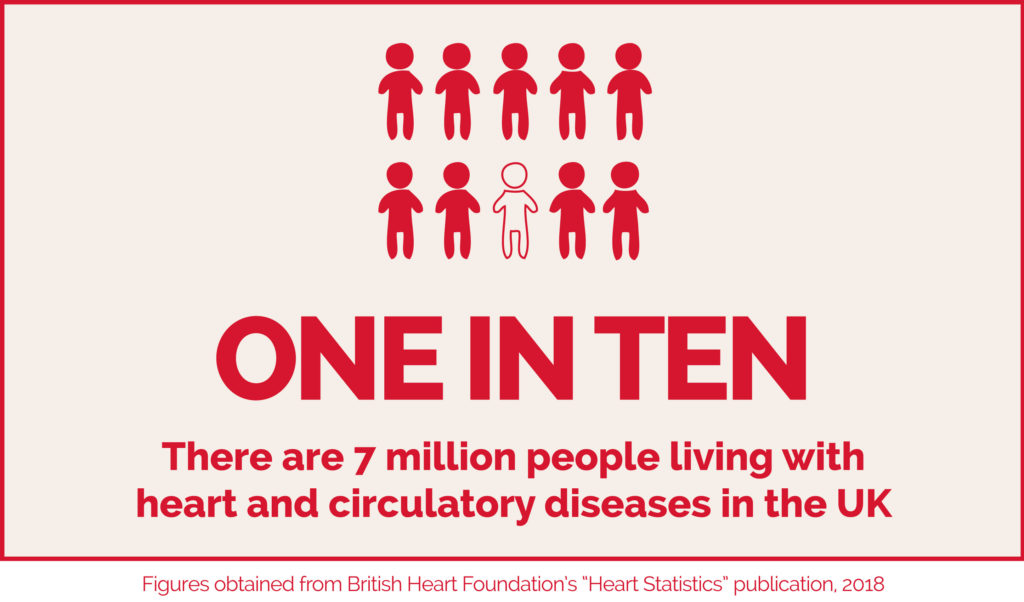

There are currently around 7 million people living with heart and circulatory diseases in the UK – that’s over 10 percent of the population[1]. An ageing and growing population and improved survival rates from heart and circulatory events (such as heart attack) could see this number increase in years to come. From conversations we have with clients, we know that many people wrongly assume that their heart condition automatically means they aren’t eligible to get any Life Insurance.

Around 80 percent of people with heart and circulatory diseases have at least one other health condition[1], which makes it even harder for these people to find an insurer willing to offer them Life Insurance, even with the help of their financial advisor.

Financial advisors don’t want to tell their clients they are uninsurable. This is why a growing number of financial advisor firms have an arrangement with specialist brokers like Moneysworth to handle their declined Life Insurance cases.

They care about their clients and realise they have a duty of care to help them find the insurance they need, even if that means referring the client to a specialist broker. This duty of care is the key reason why financial advisors should have contingency plans for signposting their clients to a specialist.

The financial advisors who come to us rely on our specialist expertise. Our careful research not only helps to ensure their client has the best chance of being offered cover, but quite often results in that cover being offered at a surprisingly affordable price.

Most important of all, our comprehensive approach also means the client can feel that the insurance cover they’ve purchased is fit for purpose so that – if the worst happens – the policy will pay out.

A financial advisor firm recently approached us having tried, unsuccessfully, to find Life Cover for their client who has a heart condition.

The client is a male in his early forties who was diagnosed with Cardiomyopathy over ten years ago. Cardiomyopathy is a disease of the heart muscle which affects its size, shape and structure.

At this time, he was also fitted with an ICD (Implantable Cardioverter Defibrillator) – a life-saving device which is surgically implanted inside a patient’s chest if their cardiologist believes there is a real risk that the heart could suddenly stop beating. An ICD is a defibrillator that automatically detects if the heart stops and immediately shocks the heart to start it beating again.

The client has annual medical reviews and, despite the seriousness of his heart condition, he has no symptoms whatsoever.

We were not surprised that the client and his financial advisor had experienced difficulty in finding an insurer willing to offer cover. We knew that the majority of Life Insurance companies will decline an application where an ICD had been fitted – especially given the underlying heart condition diagnosed at such a relatively young age.

When we completed our research for this case, virtually all insurers in the marketplace confirmed they would decline an application for Life Insurance. But because we were thorough, we found two insurance companies willing to give further consideration to an application, subject to seeing a GP report.

With the client’s permission, these two insurers obtained a GP report including a letter from the cardiologist.

One of these insurers then declined the application, but the other offered mortgage term assurance with no exclusions and for the full sum the client needed (over £200,000) for the whole term of the mortgage (over 20 years) for less than £100 per month.

A satisfying result for us, for the financial advisor and for their client!

Notes:

1. Figures obtained from British Heart Foundation’s “Heart Statistics” publication, 2018: https://www.bhf.org.uk/what-we-do/our-research/heart-statistics

Here at Moneysworth, we’re big fans of signposting. What do we mean by that?

For an insurance provider, it’s about considering consumers’ needs – even if that insurer cannot accommodate the special needs that an increasing number of consumers have.

For example, what happens when a consumer is shopping around for life insurance and they are refused cover because they have a health condition which makes them a higher risk for insurance? This can, often incorrectly, cause consumers to think that they’re uninsurable and to give up looking for cover.

Consumers with health conditions rely on charities for information and guidance to help them overcome the complexities they face, including the difficulties of searching for suitable insurance cover.

The British Heart Foundation (BHF) is the UK’s leading charity for funding research into heart and circulatory diseases and their risk factors. For several years, Moneysworth and other specialist brokers have been listed [1] on the BHF’s website or in its guidance publications. We don’t always know how people find us, but we do know from our conversations with clients that many people come to us after contacting the British Heart Foundation. This is signposting in action!

The review shown at the top of this article was written by a male client in his late twenties who was determined to protect his family’s financial future.

The problem was that, because of his heart condition, he couldn’t find an insurer who would offer him Life Cover. Soon after being born, he’d been diagnosed with a bicuspid aortic valve and coarctation of the aorta. When he was a teenager, he had open heart surgery, followed by a week in hospital and six months recuperation before returning to school.

Ever since then, he’s had annual checks at a hospital, but has no symptoms and doesn’t even need to take medication. He has no other health issues and no family history of heart defects or heart disease. He is able to work in a physical role and has an active lifestyle. Indeed, the reason he has a mortgage is because he has a steady job and income!

Yet every insurer he contacted declined to offer him Life Cover because of his medical history of having a rare heart condition.

After years of unsuccessfully searching for an insurer who would offer him suitable cover, he was signposted to Moneysworth via the British Heart Foundation.

With our specialist knowledge of the insurance market, combined with our medical knowledge, we were able to help the client find the cover he needed to protect his family’s financial future. He successfully applied for and started a Decreasing Life Insurance policy for almost £400,000 to cover a repayment mortgage over 35 years, for just under £50 per month.

Thanks to the British Heart Foundation making the effort to provide appropriate guidance and signposting, many people with heart conditions are able to find Life Cover after they’ve been declined by mainstream insurers.

Notes: