Moneysworth wins Best Small Protection Advice Firm 2023!

Learn more

Call us 01625 462 744

There’s no denying the fact that if you have a Body Mass Index (BMI) of more than, say 30, it gets harder to obtain life insurance. At this level, you are considered to be ‘medically obese’, and not only might you have to pay a higher premium, but some insurers might automatically reject your application should you apply to them directly.

Your BMI number – your weight in kilograms divided by the square of your height in metres – is an important consideration for life insurers when deciding whether to offer cover and at what price. They will, however, also consider other factors, such as your age, your personal medical history and the medical history of your close relatives.

The solution here might be to approach a specialist broker such as Moneysworth. We specialise in finding life insurance for clients whose circumstances are a little different – perhaps because they reside overseas, have a riskier occupation or have a mental or physical health concern. We have an extensive knowledge of the criteria used by different insurers and can identify the provider who will offer you the most suitable cover. For example, not all insurers have the same ‘maximum BMI’, so if one provider tells you your BMI is too high, we can approach another insurer on your behalf.

On 2nd August 2023, we were endorsed in the national press (the Daily Mail) as an example of a specialist broker who can assist in situations such as this. Alan Lakey, director at Highclere Financial Services, and a respected name in the life insurance sector, listed us as one of three specialist companies who can assist clients with high BMI and with other health issues.

When we look at 15 life insurance companies used by Moneysworth, we see that:

It’s also important to consider the BMI level that would prompt an insurer to increase your premium. Again, the precise threshold varies between different providers, but most will require you to pay more if your BMI is 32 or above, and some will ‘load’ your premium for a BMI as low as 29.

It’s very difficult for the average consumer to gain a detailed understanding of individual insurers’ criteria. If you have a high BMI, your best option is to make use of a specialist broker such as Moneysworth. We can use our detailed knowledge of insurers’ criteria to find you the very best price available, by approaching the insurers who are likely to consider your application favourably.

Here, it was immediately apparent that a number of insurers were prepared to offer cover to both clients. Where Moneysworth’s specialist knowledge benefitted the clients was that we knew exactly by how much each insurer would increase the premium. Had the clients simply searched a price comparison website and applied to what appeared to be the cheapest provider, this provider may no longer have been the cheapest option once their final offer of terms had been made.

In this case, both partners took out £113,000 of cover over 40 years. The female client’s premium was £12.58 per month, while the male client needs to pay just £9.04.

Then, as a more extreme example of how we can help:

After researching their situation, we told them that while most insurance companies would still say no, we believed we had found a company who might say yes. The insurance company wrote to the client’s GP for a report and the client also attended a brief medical screening. The insurance company was happy with the results and made a definite offer of cover, which the client was happy to accept, of £56,075 decreasing life cover over 20 years for £50 per month.

If you have approached insurers directly and been declined, or have been told by another broker that you can’t get life insurance due to your BMI or any other health issue, then contact Moneysworth today to see how we can help.

This week is National Obesity Awareness Week – a time to reflect on how being overweight can affect health, how to eat more healthily, and to consider being more physically active.

The risk of developing weight-related health issues is why Life Insurance companies need to know your BMI (body mass index) – a measure that uses your height and weight to work out if your weight is healthy.

Well, it does usually mean the price of the insurance is higher compared to someone with a healthy weight and no other health problems. But you may be surprised to learn that, even with a very high BMI, it’s still possible to get Life Insurance.

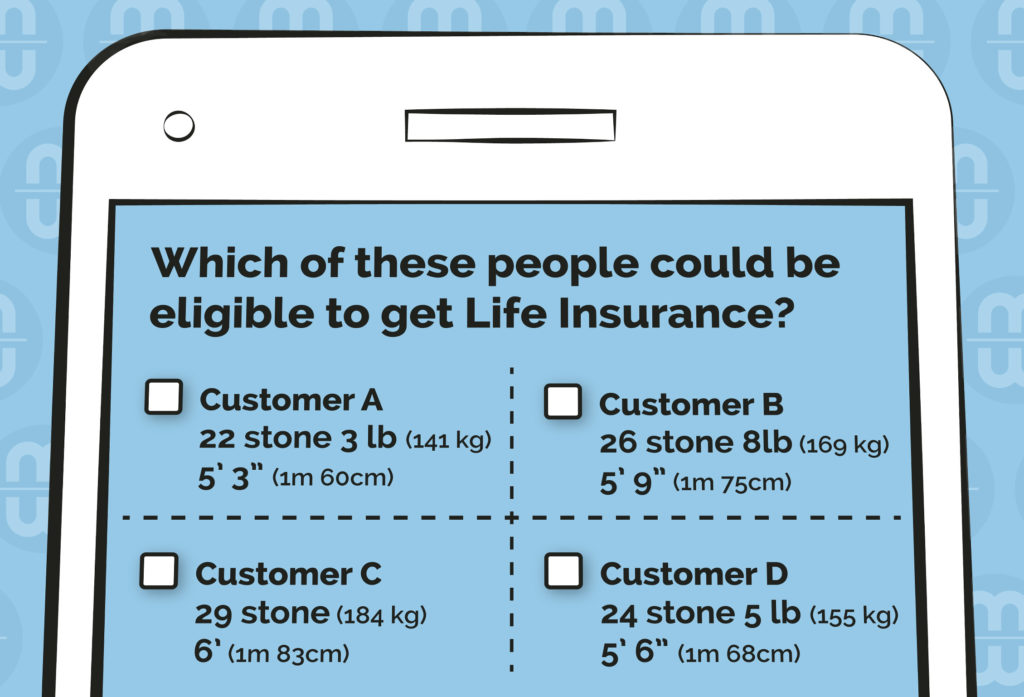

The answer is ALL of them!

Each of the four people has a BMI of 55, which health professionals consider to be in the very high range of obesity levels.

Different insurers set different maximum BMI limits. So, even though these four people have a high BMI, some insurers may offer them Life Cover. That decision, and the price offered, will of course depend on other factors too, such as the applicant’s age, other health conditions and any relevant family medical history.

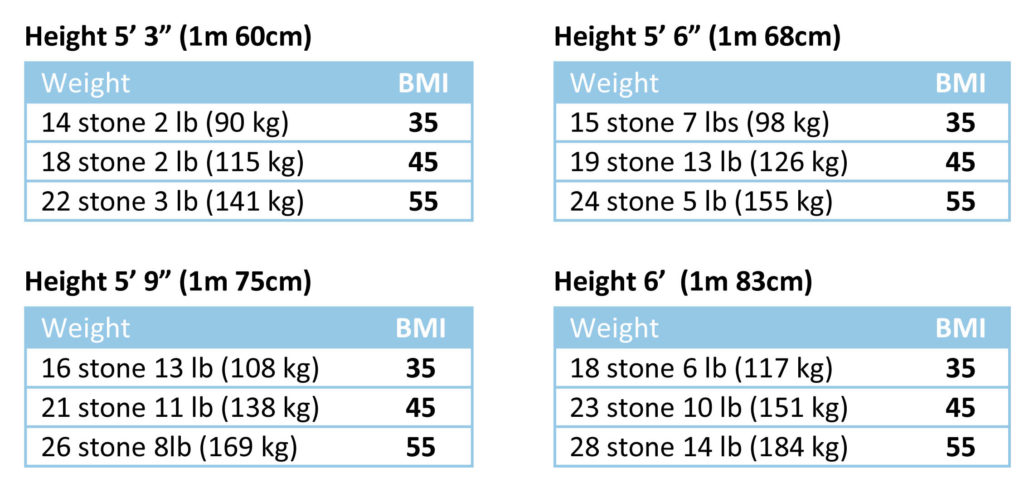

Here’s a range of examples of BMI (Body Mass Index) for adults, who have different heights and weights:

If you know your height and weight, you can use the NHS’s Healthy Weight Calculator to find out your BMI.

Even if you’re still in your 20s or 30s, you feel healthy and high BMI is your only medical issue, you may be charged more for your insurance cover.

This is because insurers don’t just consider your present state of health – they also assess the effect of the raised BMI throughout the proposed term (length) of the insurance cover that you’re asking for.

Recently, we’ve found some insurers who will offer to reduce the monthly cost for your life cover if your BMI improves due to weight loss.

Critical Illness cover and Income Protection cover are typically harder to obtain for people with a high BMI, especially if there are other health conditions to consider. But it may be still be possible for some people – it all comes down to your overall circumstances: BMI, age, other health conditions, family medical history, etc.

Most mainstream insurance companies will have a tolerance level for BMIs up to around 40-45, providing there are no other health conditions present.

If you have other healths conditions too, or have a BMI higher than the mid forties, your search for cover is mostly likely going to be harder.

This is why asking an expert to shop around for you is a good idea. Moneysworth have over fifteen years of success in finding life insurance for people with high BMI and other health conditions. We are usually able to obtain life cover for a maximum of BMI of 55, and in some cases even up to 60. We don’t charge clients any fees to search the insurance market, so it won’t cost you a penny to ask us to fully explore your Life Insurance options.

Learn more about Life Insurance and high BMI / Obesity.