Moneysworth wins Best Small Protection Advice Firm 2023!

Learn more

Call us 01625 462 744

You could now be eligible for a new type of Life Cover to help protect your family’s financial future.

Today is World Mental Health Day – a time to consider how mental health problems such as anxiety and depression could affect anyone at some point in their lives. It’s also a time to reflect on the social stigma that often surrounds severe mental health problems.

The statistics for mental health in the UK are alarming. Around 1 in 4 of people experience a mental health problem each year. At least 1 in 5 people have had suicidal thoughts in their lifetime. Around 1 in 15 people have self-harmed or attempted to take their own life. *

This year’s theme for World Mental Health Day is suicide prevention.

Just like anyone else, people suffering with a severe mental illness want to do what they can to protect their loved ones’ future, such as obtaining Life Insurance.

Until recently, the chances of being offered cover would have depended on the specific details of their circumstances, such as how many suicide attempts there have been, and how long ago they occurred. Even today, this is the situation with most (but not all) insurers.

UK insurer Royal London has created a new Life Insurance option that’s been specifically designed for individuals with severe mental health conditions who would otherwise be declined cover.

This new option is available to many people who have had a significant mental health event in the last five years (such as suicide attempt, suicidal thoughts, self-harm, or in-patient treatment at a psychiatric ward). It’s also typically available at a more affordable price.

Moneysworth has helped many people with different mental health problems to find suitable Life Insurance. This is because we’re well placed to help people in this situation. We have personal experience of some of the key issues involved and detailed knowledge of the Life Insurance market.

We help to ensure all relevant medical evidence for each applicant is presented as a comprehensive case to the insurer. This evidence is assessed by a specialist group of underwriters at Royal London, which helps to avoid mild conditions being classed as a higher risk.

As a result of this trial, Royal London has been able to offer cover to 75% of applicants who would otherwise have been deemed uninsurable.

“The response from customers and advisers has been overwhelmingly positive and we’ve seen high take up rates for cover despite the underwriting process being longer.”

Craig Paterson, underwriting and claims philosophy manager at Royal London

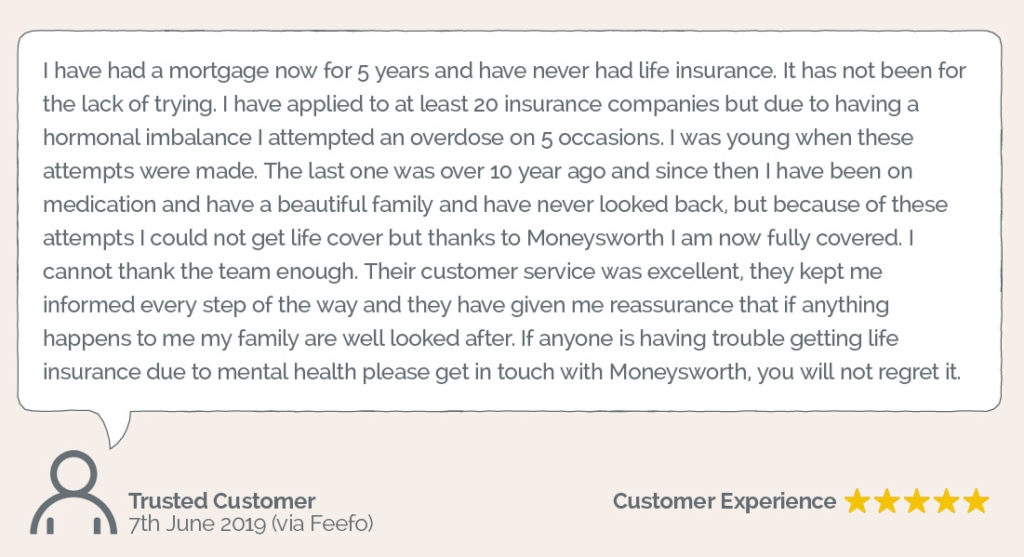

Here is a review of our service by one of the many clients we’ve helped to find cover this year:

If you have other health conditions, or have had a significant mental health event within the past five years, your search for cover is mostly likely going to be harder.

This is why asking an expert to shop around for you is a good idea. Moneysworth have over fifteen years of success in finding cover for people with mental and physical health conditions

We don’t charge clients any fees to search the insurance market, so it won’t cost you a penny to ask us to fully explore your Life Insurance options.

* Statistics source: Mind

https://www.mind.org.uk/information-support/types-of-mental-health-problems/statistics-and-facts-about-mental-health/how-common-are-mental-health-problems/