Moneysworth wins Best Small Protection Advice Firm 2023!

Learn more

Call us 01625 462 744

Here at Moneysworth, we’re big fans of signposting. What do we mean by that?

For an insurance provider, it’s about considering consumers’ needs – even if that insurer cannot accommodate the special needs that an increasing number of consumers have.

For example, what happens when a consumer is shopping around for life insurance and they are refused cover because they have a health condition which makes them a higher risk for insurance? This can, often incorrectly, cause consumers to think that they’re uninsurable and to give up looking for cover.

Consumers with health conditions rely on charities for information and guidance to help them overcome the complexities they face, including the difficulties of searching for suitable insurance cover.

The British Heart Foundation (BHF) is the UK’s leading charity for funding research into heart and circulatory diseases and their risk factors. For several years, Moneysworth and other specialist brokers have been listed [1] on the BHF’s website or in its guidance publications. We don’t always know how people find us, but we do know from our conversations with clients that many people come to us after contacting the British Heart Foundation. This is signposting in action!

The review shown at the top of this article was written by a male client in his late twenties who was determined to protect his family’s financial future.

The problem was that, because of his heart condition, he couldn’t find an insurer who would offer him Life Cover. Soon after being born, he’d been diagnosed with a bicuspid aortic valve and coarctation of the aorta. When he was a teenager, he had open heart surgery, followed by a week in hospital and six months recuperation before returning to school.

Ever since then, he’s had annual checks at a hospital, but has no symptoms and doesn’t even need to take medication. He has no other health issues and no family history of heart defects or heart disease. He is able to work in a physical role and has an active lifestyle. Indeed, the reason he has a mortgage is because he has a steady job and income!

Yet every insurer he contacted declined to offer him Life Cover because of his medical history of having a rare heart condition.

After years of unsuccessfully searching for an insurer who would offer him suitable cover, he was signposted to Moneysworth via the British Heart Foundation.

With our specialist knowledge of the insurance market, combined with our medical knowledge, we were able to help the client find the cover he needed to protect his family’s financial future. He successfully applied for and started a Decreasing Life Insurance policy for almost £400,000 to cover a repayment mortgage over 35 years, for just under £50 per month.

Thanks to the British Heart Foundation making the effort to provide appropriate guidance and signposting, many people with heart conditions are able to find Life Cover after they’ve been declined by mainstream insurers.

Notes:

This February is National Heart Month, a time for each of us to reflect on how we can improve the health of our heart. Living with a heart condition can affect not only the individual but their loved ones too.

Having a heart condition has become one of the most common medical problems among clients who ask us to help them find Life Cover.

Source: British Heart Foundation statistics

Finding Life Insurance that suits your needs can be much harder if you’ve had a heart attack, a cardiac arrest or are living with a heart condition. Moneysworth specialise in helping people find Life Cover even if they have a health condition or have been refused life cover elsewhere.

The most common heart condition we see in our work is a previous heart attack (also known as myocardial infarction). However, over the last seven months, we’ve helped over ninety people with a wide variety of other heart conditions to find life cover. Many of these clients have now successfully started their policy or are currently in the process of applying for cover.

Over the next few weeks, we’re going to post a series of articles about the circumstances behind some of our clients’ search for life cover: why they needed life insurance, the problems they’d previously encountered when trying to apply for cover elsewhere, and the policy options and prices we were able to obtain for them.

It may surprise you to see how people who are living with a serious heart condition – or even multiple conditions – are still able to find cover, thanks to our team’s expert guidance and assistance.

This week is National Obesity Awareness Week – a time to reflect on how being overweight can affect health, how to eat more healthily, and to consider being more physically active.

The risk of developing weight-related health issues is why Life Insurance companies need to know your BMI (body mass index) – a measure that uses your height and weight to work out if your weight is healthy.

Well, it does usually mean the price of the insurance is higher compared to someone with a healthy weight and no other health problems. But you may be surprised to learn that, even with a very high BMI, it’s still possible to get Life Insurance.

The answer is ALL of them!

Each of the four people has a BMI of 55, which health professionals consider to be in the very high range of obesity levels.

Different insurers set different maximum BMI limits. So, even though these four people have a high BMI, some insurers may offer them Life Cover. That decision, and the price offered, will of course depend on other factors too, such as the applicant’s age, other health conditions and any relevant family medical history.

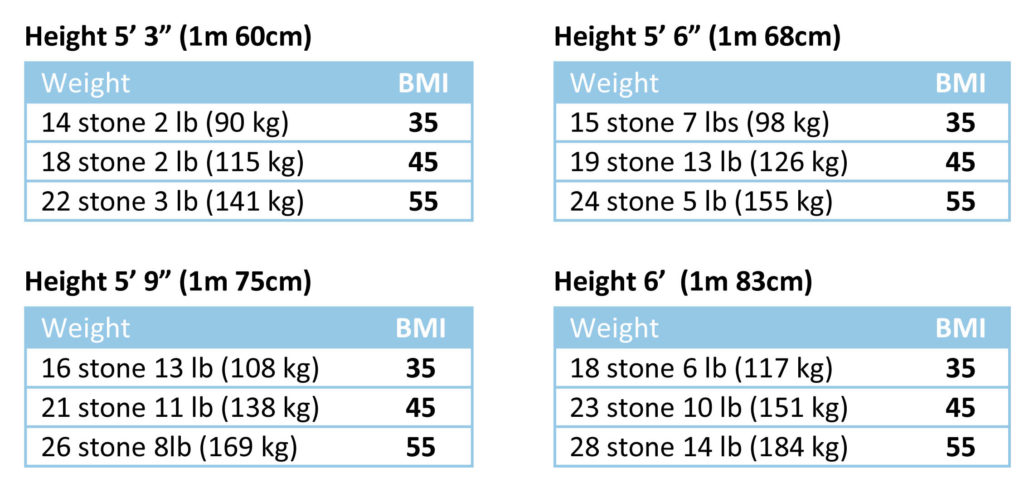

Here’s a range of examples of BMI (Body Mass Index) for adults, who have different heights and weights:

If you know your height and weight, you can use the NHS’s Healthy Weight Calculator to find out your BMI.

Even if you’re still in your 20s or 30s, you feel healthy and high BMI is your only medical issue, you may be charged more for your insurance cover.

This is because insurers don’t just consider your present state of health – they also assess the effect of the raised BMI throughout the proposed term (length) of the insurance cover that you’re asking for.

Recently, we’ve found some insurers who will offer to reduce the monthly cost for your life cover if your BMI improves due to weight loss.

Critical Illness cover and Income Protection cover are typically harder to obtain for people with a high BMI, especially if there are other health conditions to consider. But it may be still be possible for some people – it all comes down to your overall circumstances: BMI, age, other health conditions, family medical history, etc.

Most mainstream insurance companies will have a tolerance level for BMIs up to around 40-45, providing there are no other health conditions present.

If you have other healths conditions too, or have a BMI higher than the mid forties, your search for cover is mostly likely going to be harder.

This is why asking an expert to shop around for you is a good idea. Moneysworth have over fifteen years of success in finding life insurance for people with high BMI and other health conditions. We are usually able to obtain life cover for a maximum of BMI of 55, and in some cases even up to 60. We don’t charge clients any fees to search the insurance market, so it won’t cost you a penny to ask us to fully explore your Life Insurance options.

Learn more about Life Insurance and high BMI / Obesity.

Having type 1 or type 2 diabetes often makes it harder or even impossible to find suitable Life Cover, Critical Illness Cover and Income Protection.

Life insurance companies typically have a range of different premium rates for people with diabetes. Different companies will place the same person in different price bands. The process of applying for cover can often take weeks – or even months – if medical reports need to be obtained and checked. And although the situation has somewhat improved for Life Cover in recent years, most insurers are still unwilling to consider Critical Illness or Income Protection for people with any type of diabetes.

Well, there’s definitely some good news here.

In recent years, we’ve seen improvements in the prices for Life Cover typically offered to people with diabetes.

Another encouraging development we’ve seen with a couple of insurers: after starting the life insurance policy, the insurers reward policyholders by reducing premiums if the customer can demonstrate improved control (i.e. if their HbA1c reading comes down by a certain amount). We think this is a very encouraging sign, not just because it can make cover cheaper, but because it demonstrates that the insurance market is starting to consider how to adapt to the unique circumstances of people with long-term health conditions.

If certain criteria are met, it’s now possible for people living with diabetes to get a “fast-track” application, which means cover could be in place immediately. Less stress, more peace of mind – exactly the kind of innovation we want to see for people with long-term health conditions who want to protect their financial security and their family’s future.

A year ago, there were hardly any options for people with diabetes to obtain Income Protection Insurance. For most it simply wasn’t available.

Moneysworth campaigned to improve that situation, and we’re pleased to see at least some people in the insurance industry listened to us!

With expert guidance, it’s now possible for some people who have type 2 diabetes to get Income Protection with no exclusions, subject to certain criteria. But for people with type 1 diabetes, although there is some availability, it’s extremely limited.

The situation for Critical Illness Cover has been slow to improve. It is now possible for people living with diabetes to obtain Critical Illness Cover – but the options are very limited and the chances of being offered cover are even narrower if they have type 1.

The small signs of progress we’ve seen in the market are a welcome start, but the fact is most insurance companies still don’t offer either of these protection products to people who have diabetes.

The charity Diabetes UK reports that there are around 3.7 million people who have been diagnosed with diabetes in the UK, and that figure is predicted to rise to 5 million by 2025*.

In light of this, we firmly believe that the insurance market needs a surge of innovation to make its products and services more forward-thinking and inclusive.

Moneysworth wants to see cover options and availability broaden for people living with diabetes, and so we’ll continue to lobby the insurance industry.

* Source: Diabetes UK ‘Facts & Figures‘

At this time of year, many people are sticking to their New Year’s resolutions and, for some, giving up smoking is one of the biggest challenges. Quitting smoking is beneficial to your health, but how does it affect your Life Insurance?

1. Smokers pay higher premiums than non-smokers – but how much higher?

For a new life insurance policy, a 30-year-old can typically expect to pay 66% more, a 45-year-old 112% more and a 60-year-old 136% more. Proof (if proof were needed) that smoking is not good for your health or your wealth! For further information on the Health Risks Of Smoking (NHS).

2. What about ex-smokers taking out a new Life Insurance policy – how are they dealt with?

Broadly speaking, it will depend on how long ago the applicant gave up smoking. For a life insurance company to charge a non-smoker rates, the period since last smoking needs to be least 12 months. ‘Non-smoking’ in life insurance company terms means no use of any tobacco or nicotine products for 12 months, which even includes E-cigarettes, patches or gums.

A ‘social smoker’ or occasional smoker is still classed as a smoker – and charged as a smoker!

3. Can insurance companies test for smoking?

Yes. The test used is called a cotinine test and a life insurance company can request such a test as part of their assessment process for a life insurance application.

Indeed, if the insurer requires you to attend a nurse screening or medical exam as part of the process, and you’ve told them you’re a non-smoker, they will test you at that time anyway. In addition to this, many peoples’ GP medical records contain information about their smoking habits.

4. What if someone is now an ex-smoker, but they have an existing Life Insurance policy taken out while they were still a smoker?

There may be the potential to get a lower premium rate – but it won’t happen automatically, and you will need to take action in order to explore this potential option. Some companies will, if requested, be prepared to alter the premium on your existing plan from smoker to non-smoker rates, once they have satisfied themselves of your non-smoking status (12 months non-smoking – and expect to be asked to do a cotinine test).

However, the majority of insurance companies will not be prepared to change your existing policy terms and therefore in order to obtain non-smoker premium rates you will need to make a fresh application. It is very important that if you do make a new application that you do not cancel your existing policy until the new policy has started. This is because a new application means a fresh assessment, taking into account your age (obviously you will be older) and any changes in your health. Remember that, for some people, these factors could make the final ‘non-smoker’ premium for the new application more expensive than the old policy ‘smoker’ premium rate. Indeed, in a few cases, health changes might be so significant that a new policy is not available.

5. If someone is thinking about giving up smoking – is it best for them to wait until they become a non-smoker before applying for life insurance?

No. Waiting is a big mistake and could cost you dearly! Nobody likes paying more than they need to and you might be tempted to wait until premiums become cheaper.

But there are a number of risks with this approach:

Firstly, and most importantly, waiting until you qualify for non smoker premium rates leaves your loved ones with no cover and still fully exposed to the financial consequences of you dying before you complete the qualifying conditions for non-smoker premium rates.

Secondly, changes to your health might occur before qualifying for non smoker premium rates, which could mean that the cost of cover actually increases and, in the worst cases, becomes unavailable – which could amount to a potential disaster.

Thirdly, as a smoker today you don’t know how long in reality it may take you to complete a full continuous period 12 months of non-smoking. When will you quit? How long will you use nicotine substitutes? Will you have an occasional cigarette? For some, despite their good intentions, they may never reach a point where they have not smoked or used any nicotine replacement products for 12 months.

If higher premium rates for smoking are a real concern then rather than doing nothing it is better to consider taking out a lower amount of cover now, with a view to reviewing the amount of cover as and when non smoker premium rates become available.

Tips for smokers applying for Life Insurance:

It’s worth also remembering that the potential longer term consequences of smoking involve a greater risk of certain health conditions, several of which (such as heart attack, lung cancer, other cancers, stroke, etc.) are potentially claimable conditions for Critical Illness insurance policies.

What is generally not realised nor fully understood is that millions of people in the UK are unable to obtain a Critical Illness policy due to an existing health condition. We tend to pick up health conditions as we age and smoking increases the risk of certain health conditions. So, for smokers, it might well be a good idea to consider taking out Critical Illness Insurance sooner rather than later – especially for younger smokers, for whom premium rates are often significantly lower compared to older smokers.